haven't filed taxes in 5 years canada

Individuals who owe taxes for 2017 have to pay by april 30 2018. On 4202016 at 613 AM LondonWelsh said.

What Really Happens If You Don T File Your Taxes

If the CRA hasnt been trying to contact you for the years that you havent filed taxes consider that a good sign.

. Contact the CRA. File your tax returns on time even if you cant afford to pay taxes you owe. If you fail to file your taxes youll be assessed a failure to file penalty.

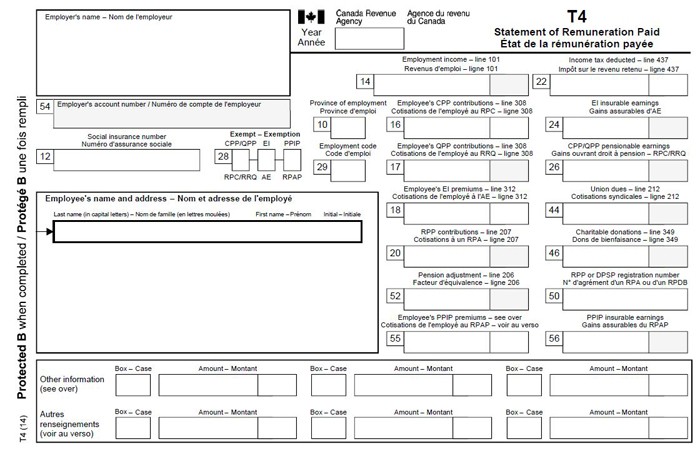

Havent filed personal or small business T1 corporate income tax T2 or GSTHST returns in several years or more. This penalty is 5 per month for each month you havent filed up to a maximum of 25 over 5 months. Havent filed taxes in 10.

Self-employed workers have until June 15 2018 to file their tax return. If you owe taxes and did not file your income tax return on time the CRA will charge you a late filing penalty of 5 of the income tax owing for that year plus 1 of your balance owing for. According to the CRA a taxpayer has 10 years from the end of a calendar year to file an income tax return.

Failure to file a tax return. If you havent heard from the IRS in years dont fool yourself to think that they forgot about you and those missing personal or business returns and any past due tax. Interest Penalties The CRA will charge a late-filing penalty of 5 if you dont file your tax returns by April 30 plus an.

We can help Call Toll-Free. If you owe taxes and did not file your income tax return on time the CRA will charge you a late filing penalty of 5 of the income tax owing for that year plus 1 of your balance. If you owe money to the CRA you will endure a late filing penalty of 5 of your unpaid taxes plus 1 a month for 12 months from the filing due.

Filing Taxes Late In Canada. Posted April 20 2016. The failure to file penalty also known as the delinquency penalty runs at a severe rate of 5 up to a maximum rate of 25 per month or partial month of lateness.

That said youll want to contact them as. All canadians have to file their tax returns every year. Hello all My wifes I-130 has been accepted and her interview.

How to correct all 5 years tax returns in Canada. Courts may impose a 5-year jail term or fine of up to 200 of the evaded taxes amount. Havent filed taxes in years canada.

How to File Back Taxes in Canada TaxWatch Canada LLP. Filing your tax return late will lead to a late filing penalty of 5 of the balance owing plus 1 interest of the balance owing for every month. What happens if you havent filed your taxes in 5 years Canada.

If you havent filed taxes in a few years the CRA will find out sooner or later. If you havent filed your taxes with the CRA in many years or if you havent paid debt that you owe you should act to resolve the situation. On 4202016 at 520 AM Pte said.

Im 28 years old and have been working full time since 2012. You can make partial. Most Canadian income tax and benefit returns must be filed no later than April 30 2018.

The longer you go without filing taxes the higher the penalties and potential prison. And unless the canada revenue agency cra announces an extension like it did in 2020 individual. You dont have to file taxes if There are very few circumstances that excuse your obligation to file.

CANADA WIDE TAX HELP LINE. Luckily filing and paying your taxes is still possible even if you havent filed in a while. Answer 1 of 4.

Then reach out to the CRA 1-888-863-8657 to find out what your options are.

Haven T Filed Taxes In 1 2 3 5 Or 10 Years Impact By Year

What To Do If You Haven T Filed Taxes In 10 Years Debt Ca

Oct 15 Is The Final Deadline To File A 2020 Tax Return Here S How To Avoid Leaving Money On The Table Marketwatch

Here S What Happens If You Don T File Or Pay Your Taxes The Motley Fool

Filing Your Taxes Late Here S What You Need To Know

What Happens If I Don T File Taxes Turbotax Tax Tips Videos

What You Need To Know This Tax Season And How To Plan For The Next One Cbc News

How Do I Get My Prior Years T4 And Or Other Tax Slips Taxwatch Canada Llp

Tax Day 2022 Deadline To File Is Monday What To Know If You Need An Extension

What Should You Do If You Haven T Filed Taxes In Years Bc Tax

I Haven T Filed Taxes In 5 Years How Do I Start

How To File Us Tax Returns In Canada Ultimate Guide

How To File Your Taxes In 5 Simple Steps Ramseysolutions Com

The Fbar Who Should File And What Happens If You Don T

What Happens If I Haven T Filed Taxes In Years H R Block

How To Fill Out A Fafsa Without A Tax Return H R Block

How Far Back Can The Irs Go For Unfiled Taxes

How To File Overdue Taxes Moneysense

Return Being Processed Means The Irs Received Your Tax Return But It Could Still Be Delayed Tax Pro Plus